BY: Todd Horwitz, Host & Senior Contributing Analyst

PUBLISHED: August 18, 2015

Stagnant Economic Growth Remains

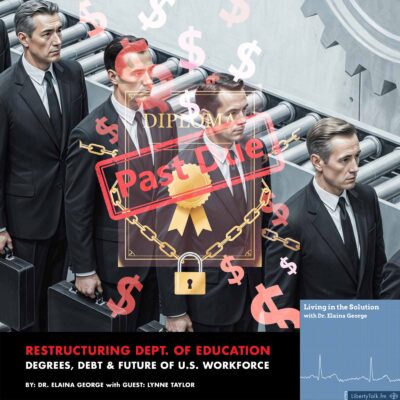

Todd opens this episode of The Bubba Show by lamenting the lack of economic growth in the U.S. to wit he believes that the FEDERAL RESERVE’s money printing policy unto the politically correct name of Quantitative Easing has led to the inflation of an equity bubble. Moreover Todd adds that unless there is a fundamental shift in policy towards a true Capitalist free market it is only a matter of time until things collapse yet again with the real potential to be worse than the Housing Bubble collapse of 2008. While Todd will not predict with certainty when however when one adds in the economic woes of China into the mix, a happy ending to the story becomes ever more difficult to imagine.Thereafter, Bubba discusses the burgeoning student and auto loan bubbles to wit now combined in excess of two trillion dollars; double what they were three years prior. What happens to those loans if we hit another economic downturn as who can possibly bail out that amount of debt; the numbers are utterly staggering, i.e. a trillion is a thousand billion. As such, if just one percent of the loans default who is going to foot the bill to the tune of a $100 billion dollar price tag.

Bubba also comments he does not believe Janet Yellen will raise interest rates this year as Todd knows that the Fed funds rate gives better than a fifty-fifty chance that it will happen by the fourth quarter yet such a move does not make sense. Whereas the U.S. already has the highest interest rates of any G20 countries and according to government reports there is no indication that inflation is stifling the market, why raise interest rates if it will hurt exports?

Bubba concludes today;s show commenting that he is convinced that jobs numbers are being manipulated by the Bureau of Labor Statistics. Thus, he believes that figures don’t lie but the bureaucrats who report skew them to favor the government’s policies and positive portrait of economic progress. Specifically, Todd doubts the BLS Statistics number of an unemployment rate of 5.3%, noting that recent Gallop surveys peg the rate at 6.3% but claims the true rate is over 14% when one contrasts the claimed unemployed percentage of workers with overall workforce participation clocking in at the lowest on record since 1977. In closing, Todd also cites the increase in those seeking assistance through food stamps to further call into question the credibility of the government’s monthly jobs reports, that consistently find themselves contradicting the reality of those living on Main Street.