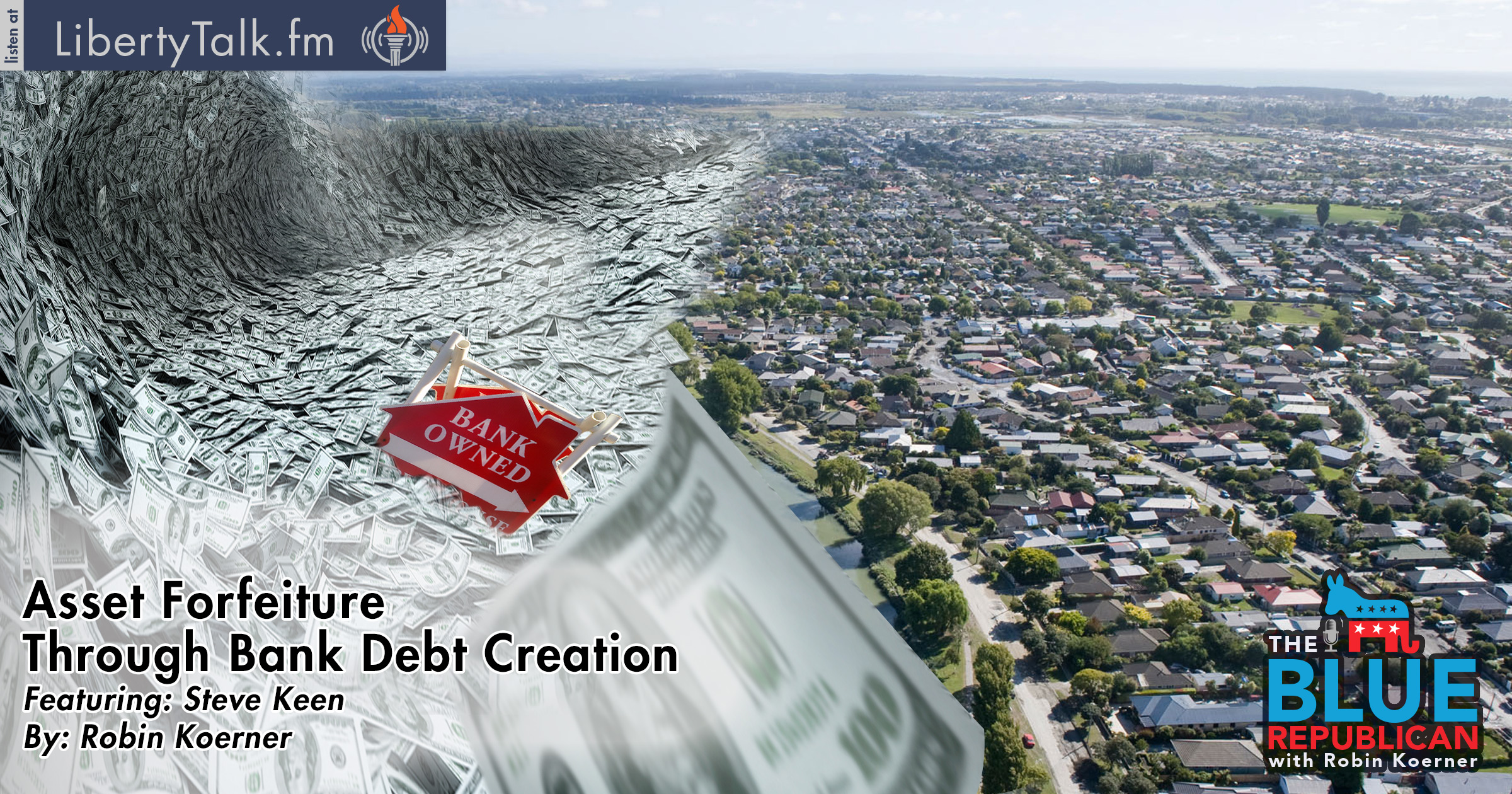

Is Asset Forfeiture an Inevitable Consequence of Fractional Reserve Banking?

Nearly all money is created by banks as debt. Is Asset Forfeiture an inevitable consequence of fractional reserve banking, could such a system be reformed?Deceleration of the massive private debt that was generated by banks caused the recent financial crisis – as it has done throughout the history of capitalism. The system of money as debt, where banks create money (principal) with liabilities (principal and interest) that exceed the money created, moves assets to the financial sector. Is this system stable? Inherently immoral?

Does most of that money finance wealth-creation, or asset inflation? Empirically, almost all of the debt-money that is created by banks goes to bidding up asset bubbles – not to entrepreneurs who create real wealth. And the way we have our monetary system structured, the banks make most of their profits by keeping things that way. So the empirical reality is a problem. Financial crises are in this sense built into our monetary system. What should we do about it?

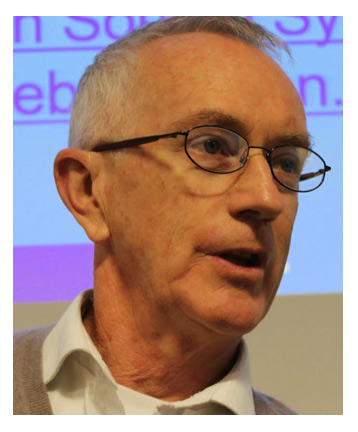

About Professor Steve Keen

[Full Bio at Forbes] • [Steve Keen’s Debt Watch – DebtDeflation]